Commodity trading instruments provide exposure to commodity price movements without requiring physical ownership. This guide explains how each major instrument—futures, options, ETFs, ETCs, CFDs, swaps, forwards, and mutual funds—works, what role it plays, and who it’s best suited for.

You’ll get clear, side-by-side insights into structure, pricing, risk, and market access to help you choose the right tool for your strategy.

Spot vs Derivatives: Core Difference in Commodity Markets

Commodity trading operates through two primary mechanisms: spot and derivative instruments. Understanding the distinction is essential for selecting the right approach to gain exposure, manage risk, or secure pricing.

Each serves a different purpose in the market structure and suits specific trading or investment goals. The core differences lie in how value is realized, risk is managed, and assets are settled.

| Spot Instruments | Derivative Instruments |

| Spot markets involve the immediate exchange of physical commodities. Transactions reflect the current market price, and settlement typically occurs within two business days. This is common in markets such as crude oil, metals, and agricultural goods where physical delivery is standard. | Derivative markets are based on financial contracts that derive value from the price of an underlying commodity. These contracts are settled on a future date and do not require physical delivery. Common instruments include futures, options, swaps, and forwards. |

| The purpose of spot trading is direct ownership or delivery. It suits participants involved in the actual commodity supply chain, such as producers, refiners, or bulk buyers. | Derivatives are used for managing price risk, speculation, or portfolio diversification. They appeal to traders, institutions, or investors seeking exposure without handling physical goods. |

| Pricing in spot transactions is determined by real-time supply and demand dynamics. | In derivatives, pricing incorporates not only the current spot price but also factors like time to expiry, volatility, interest rates, and storage costs. |

The distinction between spot and derivative instruments lies in delivery mechanism, settlement timing, and intended use case. This structural difference forms the foundation of how commodity trading strategies are applied across markets.

Comparison Table: Futures vs Options vs ETFs vs ETCs vs CFDs vs Swaps vs Forwards vs Mutual Funds

Commodity trading instruments differ significantly in structure, use case, and risk exposure. This comparison table presents a clear, attribute-wise breakdown to help traders, investors, and institutions evaluate the most suitable instrument based on their objectives, capital, and risk appetite.

Each column compares the instruments across type, leverage, risk level, liquidity, ideal holding period, associated fees, and target users—ensuring practical, skimmable decision support.

Attribute-Wise Comparison Table

| Attribute | Futures | Options | ETFs | ETCs | CFDs | Swaps | Forwards | Mutual Funds |

| Type | Derivative contract | Derivative contract | Exchange-traded fund | Exchange-traded commodity | Derivative (OTC) | Derivative (OTC) | Customized derivative | Pooled investment vehicle |

| Leverage | High | Moderate to high | None or low | Moderate | High | Customizable (usually high) | Customizable | None |

| Risk | High (margin + volatility) | High (time-sensitive) | Low to moderate | Moderate | High | Counterparty + market risk | Counterparty + market risk | Low to moderate |

| Liquidity | High (standardized markets) | High (exchange-traded) | High | Medium to high | High (broker-dependent) | Low (OTC only) | Low (custom, OTC) | Medium |

| Holding Period | Short-term | Short-term | Medium to long-term | Medium to long-term | Short-term | Medium | Short to medium-term | Long-term |

| Fees/Costs | Exchange + margin + rollover | Premiums + brokerage | Low expense ratio | Issuer + brokerage | Spreads + overnight costs | Custom fees | Custom fees | Management fees |

| Who It’s For | Active traders, hedgers | Hedgers, speculative traders | Retail & passive investors | Diversified commodity investors | Retail traders (high risk) | Institutions, corporates | Large firms, exporters | Long-term retail investors |

How These Instruments Work: Pricing, Margins, Leverage & Risk

Commodity trading instruments function based on financial mechanisms that determine their pricing, capital requirements, and risk exposure. Understanding these underlying mechanics is crucial for anyone evaluating which instrument to use, and how to manage it effectively.

This section breaks down the core factors that govern their operation in practical trading scenarios.

How Futures & Options Are Priced

Futures and options are priced using models that incorporate the value of the underlying commodity, time to maturity, market volatility, and cost of carry. While both are derivative contracts, their pricing logic and components differ significantly.

Pricing Formula for Futures (Cost-of-Carry)

Futures contracts are priced using the cost-of-carry model:

Futures Price = Spot Price + Carry Cost − Income (if any)

Carry cost includes interest rates, storage, insurance, and time to expiry.

What Influences Option Premiums

Options pricing is based on:

- Underlying commodity price

- Strike price

- Time to expiration

- Implied volatility

The Black-Scholes model is common for European-style options; binomial models are often used for American-style contracts

Leverage & Margin in CFDs, Futures, Swaps

Leverage enables amplified exposure with smaller capital, but introduces high risk. Margins act as collateral to open and maintain leveraged positions. Each instrument — CFDs, futures, and swaps — follows a different margin mechanism.

The examples below explain how leverage is structured, what margin is required, and how brokers or institutions manage risk.

Margin Requirements in Futures Trading

Futures trading involves:

- Initial margin (entry deposit)

- Maintenance margin (ongoing requirement)

- Daily mark-to-market settlements

Margin calls are triggered if the account balance drops below required thresholds.

CFD Leverage and Broker Risks

CFDs offer 10x–30x leverage, depending on the underlying asset. Margins are set by brokers, and losses can exceed deposits. Overnight holding fees and spread risks are common cost components.

Swaps and Institutional Margin Models

Swaps, being OTC derivatives, involve custom collateral agreements between parties. Margin depends on:

- Notional size

- Duration

- Counterparty credit

There’s no centralized clearing, so credit exposure is managed through margin buffers.

Risks: Volatility, Roll Costs, and Time Decay

Every instrument carries risk—some visible, others hidden. This section focuses on key risk factors that affect position value over time: volatility, the cost of rolling over contracts, and time decay. These risks vary widely depending on the type of instrument and the trader’s holding strategy.

Roll Costs in Futures and ETCs

Holding long futures or ETCs over time incurs rollover costs. When the futures market is in contango, newer contracts are more expensive, leading to value erosion upon each roll.

Time Decay in Options (Theta Risk)

Options lose value as expiration nears—especially if they’re out-of-the-money. This erosion in value, known as theta, accelerates in the final weeks before expiry.

Volatility Exposure Across Instruments

- Options become more expensive with rising implied volatility

- CFDs may trigger stop-outs in volatile sessions

- ETFs and mutual funds can deviate from NAV under stress, causing tracking error

Liquidity & Slippage Issues in Mutual Funds vs ETFs

Liquidity affects how easily you can enter or exit a position without excessive cost. ETFs and mutual funds differ significantly in this regard. This section breaks down intraday trade flexibility, pricing mechanisms, and the slippage risks associated with low-liquidity instruments.

Real-Time Trading & Bid-Ask Spreads in ETFs

ETFs trade on exchanges like stocks. Liquidity is determined by:

- Underlying asset volume

- Market maker presence

- Spread width

Low-liquidity ETFs may suffer from price gaps and tracking discrepancies.

NAV Pricing & Redemption Barriers in Mutual Funds

Mutual funds are priced only once daily at NAV. Key limitations include:

- No intraday trades

- Possible exit loads

- Delays during mass redemptions

Futures, Options, CFDs & Swaps: Tools for Active Commodity Traders

These four instruments are designed for active traders who seek short-term opportunities, manage commodity price risk, or gain leveraged exposure. Each serves different strategic roles in speculative trading, hedging, and arbitrage.

Futures Contracts – Standardized Derivatives for Short-Term Traders

Futures are exchange-traded contracts that obligate the buyer or seller to transact a specific commodity at a set price and date. They offer transparency, high liquidity, and are favored by traders looking to profit from short-term price moves or hedge future exposure.

Use Case Example

A soybean producer sells futures to lock in prices six months ahead; a speculator takes the opposite position, betting on price changes.

Who Uses Them

- Commodity producers and consumers

- Institutional hedgers

- Day traders and arbitrageurs

Key Features

- Mark-to-market daily

- Standardized contract sizes

- Exchange-regulated margin requirements

Options – Strategic Hedging and Speculation

Options provide the right, but not the obligation, to buy or sell a commodity at a preset price. They are used to hedge downside risk or capture price moves with limited capital at risk. Unlike futures, the loss is limited to the premium paid.

Use Case Example

An energy trader buys a crude oil call option to benefit from a potential price spike without committing full capital.

Who Uses Them

- Institutional investors hedging portfolios

- Commodity exporters/importers

- Traders speculating on volatility

Key Features

- Time decay and volatility sensitive

- Lower capital risk than futures

- Customizable strategies (spreads, straddles, etc.)

CFDs – Leveraged Access, Lower Entry Barrier

Contracts for Difference (CFDs) mirror the price of a commodity without owning the asset. Offered by brokers, CFDs allow high leverage, flexible sizing, and easy access to global commodity markets — often with lower capital than futures or options.

Use Case Example

A retail trader takes a long CFD position on gold during a central bank announcement to profit from expected volatility.

Who Uses Them

- Retail traders

- Margin-focused speculators

- Traders seeking access to multiple commodities without opening futures accounts

Key Features

- Broker-dependent leverage (up to 20x or more)

- No exchange; trades are OTC

- No ownership of physical asset

Swaps – Institution-Level Risk Management Tools

Swaps are customized OTC agreements where two parties exchange cash flows based on commodity price movements. They’re used by large institutions for long-term hedging or to gain exposure to commodity indices or price trends.

Use Case Example

An airline enters into a jet fuel swap to hedge against rising fuel costs over a year-long period.

Who Uses Them

- Corporates and energy firms

- Investment banks

- Commodity-linked ETFs and funds

Key Features

- Not exchange-traded

- Customized terms and durations

- Subject to counterparty risk

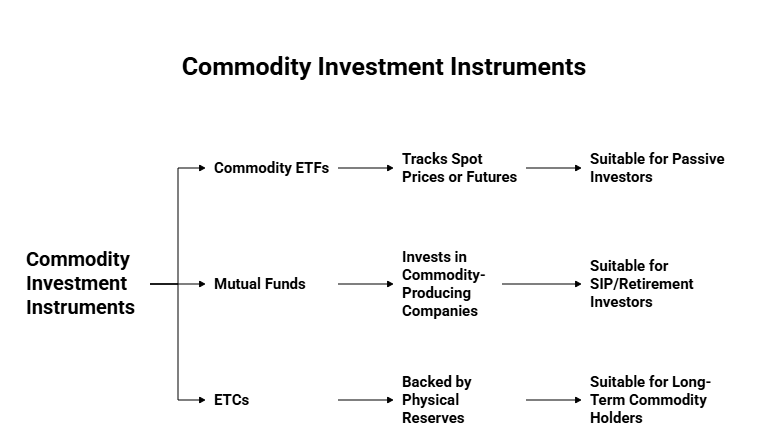

ETFs, Mutual Funds & ETCs: Instruments for Long-Term Commodity Investors

Long-term investors often seek passive exposure to commodity markets without trading contracts or managing positions. Instruments like ETFs, Mutual Funds, and ETCs allow for easier entry, lower management effort, and built-in diversification.

Commodity ETFs – Exchange-Traded Access to Commodities

Commodity ETFs provide price exposure to physical commodities (e.g., gold, oil) or futures-based indexes through exchange-traded vehicles. They’re suitable for hands-off investors wanting daily liquidity and simplified access.

How It Works

Tracks spot prices or futures via synthetic or physical replication. Trades like stocks on exchanges with live pricing.

Real-World Example

A retail investor adds a gold ETF to hedge inflation risks in a diversified portfolio.

Best Suited For

- Passive investors

- Tactical asset allocators

- Those avoiding futures contracts

Key Benefits & Trade-Offs

Liquid

Transparent

Potential tracking error

Futures-based ETFs may suffer from roll costs

Mutual Funds – Pooled Commodity Exposure via Equity & Derivative Holdings

Commodity mutual funds invest in commodity-producing companies, futures, or both — offering sectoral exposure (e.g., energy, metals, agri). Not directly tied to commodity spot prices but to the performance of related assets.

How It Works

Pooled structure. Investors buy units priced at NAV (end-of-day). Holdings may include mining stocks, energy firms, or futures contracts.

Real-World Example

An investor adds a global natural resource mutual fund for commodity-linked equity exposure.

Best Suited For

- SIP/retirement investors

- Investors preferring active management

- Conservative portfolios

Key Benefits & Trade-Offs

Diversified across companies

Managed exposure

No real-time pricing

Indirect exposure to commodity prices

ETCs – Physically-Backed Commodity Instruments (Gold, Silver, Oil)

Exchange-Traded Commodities (ETCs) are secured against physical commodities or derivatives and trade on stock exchanges. They’re popular in Europe and act similarly to ETFs but are often structured as debt securities.

How It Works

Backed by underlying physical reserves (e.g., gold bars). ETCs represent direct claims to the asset and may allow physical redemption in some cases.

Real-World Example

An investor buys a gold ETC (e.g., iShares Physical Gold ETC) to hold value in physical bullion without direct ownership.

Best Suited For

- Long-term commodity holders

- Inflation hedgers

- European investors

Key Benefits & Trade-Offs

Direct physical backing

Exchange-traded

Not available in all regions

Regulatory classification differs from ETFs

Regulatory Access: What You Can Trade and Where

Access to commodity trading instruments is determined by region-specific regulations, exchange licensing, and investor classification. The below section outlines where each instrument is legally tradable, who can access them, and the restrictions that apply — helping users navigate compliance and avoid missteps.

Futures and Options – Exchange-Traded Access with Margin and Compliance Requirements

Standardized and regulated, futures and options are available on formal exchanges and are accessible to both retail and institutional traders, subject to broker approval and margin requirements.

Where You Can Trade

- CME (U.S.): Crude oil, gold, agriculture

- MCX (India): Metals, energy, spices

- ICE (UK/US): Softs, energy, indices

Who Can Access

- Retail and institutional traders via regulated brokers

- Requires full KYC, risk disclosure, and margin setup

Regulatory Requirements & Disclosures

High transparency

Stringent regulatory oversight

Requires financial suitability checks

Limited leverage for retail traders (in some regions)

CFDs – Legal Status by Country & Regional Restrictions

CFDs offer leveraged commodity exposure without ownership. However, they face heavy scrutiny and outright bans in several jurisdictions due to investor protection concerns.

Where You Can Trade

- Allowed: UK, Australia, South Africa

- Banned: USA (CFTC), Belgium, parts of Canada

Who Can Access

- Retail traders via online CFD brokers

- Low capital threshold, high leverage, instant onboarding

Regulatory Risks & Warnings

Easy access in deregulated markets

Often lightly regulated

High loss potential, especially for new traders

Varying investor protection standards

ETCs – Regulated, Physically-Backed Products (Europe-Focused)

Exchange-Traded Commodities (ETCs) provide asset-backed exposure to physical commodities like gold or silver. Common in Europe, they’re issued as debt instruments and follow strict UCITS or MiFID rules.

Where You Can Trade

- Europe: Xetra, LSE, Euronext

- Not available in U.S. due to regulatory classification issues

Who Can Access

- Retail and institutional investors via standard broker accounts

- Subject to KYC, AML checks, and disclosure norms

Regulatory Characteristics

Physically backed

Strong investor protection (EU rules)

Jurisdiction-specific; limited global availability

Credit risk depends on issuer structure

Mutual Funds – Retail-Friendly Exposure with KYC Requirements

Commodity mutual funds offer diversified, actively managed exposure across energy, metals, or agriculture. Regulated under national securities laws, they are designed for long-term investors.

Where You Can Invest

- Available in most countries through banks, brokers, online portals

- Examples: U.S. (PIMCO, BlackRock), India (ICICI Prudential, Nippon)

Who Can Access

- Retail and institutional investors

- KYC, PAN (India), or FATCA/CRS (Global) mandatory

Regulatory Framework

SEBI (India), SEC (U.S.), FCA (UK) governed

Daily NAV, full disclosures

No intra-day trading

Limited customization compared to direct instruments

How to Choose the Right Commodity Instrument

Each commodity trading instrument serves a different purpose. Choosing the right one depends on five critical dimensions: risk appetite, time horizon, capital base, experience level, and jurisdictional or tax-related limits.

Risk Tolerance – Matching Volatility with Comfort Zone

Highly leveraged products like CFDs, options, and swaps introduce elevated risk, suitable for experienced or speculative traders. Instruments like ETFs and mutual funds, by contrast, offer reduced volatility and are better aligned with conservative profiles.

Match high-volatility instruments with risk-seeking strategies. Use passive instruments when capital preservation is prioritized.

Investment Horizon – Short-Term Speculation vs Long-Term Allocation

Futures, options, and CFDs are designed for short-term trades, often with intraday or weekly exposure. ETFs, mutual funds, and ETCs are structured for long-term asset allocation, offering gradual exposure to commodity markets.

Align instrument type with time horizon: trading for speed, funds for holding.

Capital Availability – Minimum Investment Requirements

Mutual funds and CFDs usually have low capital thresholds. Futures and swaps demand higher margins and maintenance capital. Options may require less initial capital but carry significant risk-to-reward ratios.

Consider minimum entry cost, not just potential return, when selecting an instrument.

Trading or Investing Experience – Complexity vs Simplicity

Complex instruments like swaps, options, and futures demand a deeper understanding of mechanics, margin calls, and market conditions. Simpler instruments like ETFs or mutual funds allow hands-off exposure without complex management.

Beginners should prioritize transparency and ease of use over flexibility or leverage.

Legal and Tax Constraints – Regulatory and Fiscal Fit

Instruments such as CFDs are banned in certain jurisdictions (e.g., U.S.). Taxation varies: ETFs may trigger capital gains taxes on redemption, while futures could be subject to mark-to-market rules.

Regulatory approval, KYC norms, and capital gains rules should be reviewed per location.

Always check local regulations and tax codes before selecting an instrument.

Summary: Choosing the Right Commodity Instrument for Your Strategy

Each commodity trading instrument serves a specific function based on market exposure, risk level, and use case.

- Futures, options, CFDs, and swaps are structured for active traders. They allow leverage, short-term positions, and speculative or hedging strategies, but carry higher complexity and risk.

- ETFs, mutual funds, and ETCs are built for long-term investors. They offer diversified exposure with lower volatility, regulated access, and simpler execution.

The right choice depends on:

- Risk tolerance

- Investment horizon

- Capital availability

- Trading experience

- Legal access

Understanding the structure, pricing, and settlement of each instrument is critical to aligning the tool with your strategy.

FAQs

Q1. What’s the difference between an ETF and an ETC?

An ETF is a pooled investment fund that tracks a commodity index or basket and trades on stock exchanges. An ETC is a debt instrument backed by physical commodities (e.g., gold) or derivatives. ETFs offer broader diversification; ETCs provide direct commodity exposure but carry issuer risk.

Q2. Can I trade options in commodities without owning futures?

Yes, commodity options can be traded independently on regulated exchanges. However, most are futures-style options, meaning exercising the option results in a futures contract position, not physical delivery. Margin and approval requirements still apply.

Q3. Are mutual funds better than ETFs for commodities?

Mutual funds offer active management and professional allocation but lack intraday liquidity. ETFs are passively managed, traded like stocks, and usually have lower fees. ETFs suit hands-on investors; mutual funds suit long-term, passive holders.

Q4. Is CFD trading allowed in India?

No, CFDs are banned for retail trading in India under SEBI regulations. Indian residents cannot legally trade CFDs through domestic or offshore brokers. Only regulated derivative instruments like futures and options are permitted on exchanges like MCX and NSE.

Q5. Do ETFs in gold have physical backing?

Most gold ETFs (e.g., SPDR Gold Shares, Nippon India ETF Gold BeES) are physically backed and hold allocated gold in vaults. However, some synthetic ETFs use derivatives. Always check the fund’s prospectus to verify asset backing and storage details.

Build a strong trading foundation with our blog tips.