Algorithmic traders need platforms that offer reliable APIs, low latency, and full strategy support. This 2025 list ranks the top 10 brokers based on automation readiness — API access, costs, tools, and regulation. Built for coders, scalpers, swing traders, and low-cap users alike.

Avoid poor execution and platform lock-ins by choosing brokers proven in live markets.

Scan the comparison table, filter by trading style, and match your automation stack to the right platform. Every broker here is vetted, regulated, and ready for algo deployment1 — no fluff, no bias, just performance-focused evaluation.

Compare Brokers Instantly — 2025 Table

This table outlines ten leading algorithmic trading brokers with essential specifications for fast decision-making. All brokers listed are regulated and support programmable trading infrastructure.

| Broker | Best For | API Access | Min Deposit | Fees | Tool Support | Regulation |

| Interactive Brokers | Global multi-asset strategies | REST, FIX, C++, Python APIs | $0 (IBKR Lite) | Low-tier commissions | IB Gateway, TWS, Python, 3rd-party support | FINRA, SEC, FCA |

| Alpaca | Commission-free equities automation | REST, WebSocket, Python SDK | $0 | Zero commissions | TradingView, Zapier, Python SDK | FINRA, SIPC |

| TradeStation | High-frequency and short-term trading | WebAPI, EasyLanguage | $0 | Tiered per volume | TradeStation API, TS Desktop | SEC, FINRA |

| QuantConnect | Quantitative strategy testing | Hosted IDE + Broker bridge | Varies by broker | Platform + broker fees | Lean Engine, C#, Python | Platform-dependent |

| eToro | Copy-based passive automation | Limited (eToroX API) | $10 | Spread-based | Web-based tools, CopyTrader API | CySEC, FCA, ASIC |

| IG | Retail forex and CFD automation | REST API | $250 | Variable spread | ProRealTime, MetaTrader 4 | FCA, ASIC |

| MetaTrader 5 (via Broker) | Strategy scripting and forex bots | MQL5, Web API | Varies | Broker-defined | MT5 Terminal, Expert Advisors | Broker-dependent |

| NinjaTrader | Futures algo systems | C#, .NET API | $400 | Platform + exchange fees | NinjaScript, Add-ons | NFA, CFTC registered |

| Tradier | U.S. equities via third-party tools | REST, WebSocket | $0 | $0.35 per options trade | QuantConnect, TradingView | FINRA, SIPC |

| Zerodha (India) | Domestic retail automation | Kite Connect API | ₹0 | Flat fee model | Kite Web, Console, Python, Smart API | SEBI, NSE, BSE |

1. Interactive Brokers — Best for Global Quant Strategies

Verdict:

Ideal for multi-asset algorithmic traders requiring deep API access and institutional-grade infrastructure.

Key Features:

Interactive Brokers supports REST, FIX, and proprietary APIs with C++, Java, and Python integrations. Execution latency is minimal through colocated servers (placed near exchange reducing latency to boosts speed for HFT), and smart order routing. Real-time market data and server-side bracket orders are available.

Tool Compatibility:

Native support for Python via IBAPI, third-party integrations with QuantConnect, MetaTrader, and custom frameworks through TWS and IB Gateway. Compatible with backtesting environments and broker bridges.

Costs & Commissions:

Low-tier commission model with no platform fees for IBKR Lite. Pro users face tiered fees based on volume. Data feed costs vary by region and asset class.

Pros:

- Advanced API options for multiple languages

- Institutional-grade access to 150+ markets

- No minimum deposit for IBKR Lite

- Extensive third-party ecosystem

Cons:

- Complex onboarding process

- API rate limits require optimization

- Less suited for beginners or no-code automation

2. Alpaca — Best for Commission-Free Equities Automation

Verdict:

Ideal for developers building equity trading bots with no capital barrier and full API-native architecture.

Key Features:

Alpaca provides fully-documented REST and WebSocket APIs with OAuth-based authentication. Designed from the ground up for algorithmic execution, it supports real-time market data, order lifecycle events, and trade account management. WebSockets offer streaming for quotes and positions without polling.

Latency is optimized for U.S. equity markets, with order routing through proprietary infrastructure. The platform supports fractional shares, margin trading, and extended hours execution.

Tool Compatibility:

Official SDKs available in Python, Go, and .NET. Supports TradingView signals via webhook, Google Sheets integration, and automation through Zapier. Direct compatibility with third-party quant frameworks including QuantConnect and Backtrader via API bridge.

Paper trading environments are sandboxed for live strategy testing with zero financial exposure.

Costs & Commissions:

Alpaca charges zero commissions on U.S. equities. There are no platform or data fees for retail accounts. Margin rates and short borrow fees apply to leveraged positions. Institutional users may face negotiated pricing based on volume.

Pros:

- Free access to real-time and historical U.S. equity data

- No minimum deposit required

- Full developer-first API suite with rapid documentation

- Reliable sandbox (Testing area with mock data, used to validate logic, and risk-free for experimentation) testing environment

Cons:

- Limited to U.S. equities and ETFs

- No support for futures, forex, or options

- Not suitable for non-U.S. regulatory regions

3. TradeStation — Best for High-Frequency and Short-Term Execution

Verdict:

Ideal for high-frequency and active traders requiring low-latency infrastructure and direct market access for equities, options, and futures.

Key Features:

TradeStation delivers high-speed execution through direct routing and co-located servers. It offers a proprietary WebAPI, EasyLanguage scripting, and desktop integration for automated order handling. Order types include market, limit, OCO, OSO, and conditional triggers.

Latency is minimized through SmartOrder technology and institutional-grade connectivity. Real-time streaming data feeds support active intraday strategies across asset classes.

Tool Compatibility:

Native integration with the TradeStation Desktop platform, mobile apps, and web-based terminal. Custom strategy development is enabled through EasyLanguage IDE. For external tool users, the REST WebAPI provides connectivity to third-party systems, including Python environments through community wrappers.

Backtesting and optimization modules are built into the platform. No-code strategy builders are available for visual automation.

Costs & Commissions:

Equity trading follows a tiered commission structure starting from $0 for basic accounts. Options are priced per contract, and futures incur exchange + platform fees. Subscription fees may apply for professional-grade data feeds and API access.

Pros:

- Ultra-low-latency routing with SmartOrder engine

- Proprietary scripting language for custom strategy development

- Robust desktop platform with in-built backtesting tools

- Access to equities, options, and futures in one terminal

Cons:

- Advanced features gated behind subscription tiers

- Limited third-party ecosystem outside the native stack

- Complexity in API onboarding for external developers

4. QuantConnect — Best for Strategy Simulation and Multi-Broker Deployment

Verdict:

Ideal for quantitative developers seeking institutional-grade backtesting, cross-asset support, and broker-agnostic deployment via a unified research stack.

Key Features:

QuantConnect operates on the Lean Algorithm Framework, an open-source engine enabling event-driven backtesting, live deployment, and hybrid modeling. Supports equities, futures, options, crypto, and forex. Strategy execution can be hosted via cloud, local servers, or Docker Containers.

Latency depends on the connected broker and deployment method. Execution bridging is available to multiple brokers including Interactive Brokers, TD Ameritrade, and Kraken. Slippage, transaction costs, and order fill models are customizable at code level.

Tool Compatibility:

Supports C#, Python, and F#. Built-in research notebook interface enables pre-trade analysis, signal generation, and ML model integration. APIs support seamless import/export of datasets, model parameters, and brokerage routing instructions.

Integration is possible with custom databases, TensorFlow, and cloud infrastructure for scalable automation.

Costs & Commissions:

QuantConnect follows a modular pricing model. Free tier includes limited backtests. Paid tiers unlock tick data, priority processing, and multi-broker live trading. Trading commissions depend on the connected broker. No direct execution costs via platform.

Pros:

- Open-source architecture for full strategy transparency

- Supports multiple brokers from one interface

- High-resolution historical data for accurate backtests

- Built-in research environment and cloud hosting

Cons:

- Requires programming expertise in C# or Python2

- Live trading depends on third-party broker stability

- Learning curve for Lean Engine and deployment pipeline

5. eToro — Best for Copy-Based Strategy Automation

Verdict:

Optimized for traders seeking social signal replication and passive algorithmic exposure through copy-based infrastructure.

Key Features:

eToro supports automated portfolio replication via its CopyTrader system. Strategies are mirrored in real time, with proportional execution based on account allocation. The platform hosts over 3,000 instruments across equities, crypto, ETFs, and indices.

API support is limited to eToroX (institutional crypto division), with access via REST. Strategy customization is constrained to available signals and portfolio allocation settings.

Latency is managed internally, with trade syncing typically under one second for CopyTrader users. No manual scripting or bot deployment is supported on the core retail platform.

Tool Compatibility:

Supports web-based dashboard for portfolio monitoring, strategy selection, and real-time execution. eToroX API allows crypto-specific automation and access to wallets, order books, and market depth data. No direct compatibility with Python, MetaTrader, or external frameworks.

Costs & Commissions:

eToro operates on a spread-based pricing model. No explicit commissions on trades, but spreads vary by asset. Overnight and conversion fees apply. No data or platform charges for retail users. eToroX has separate institutional pricing.

Pros:

- Zero-code strategy mirroring with risk-adjusted allocation

- Access to diverse global markets from one interface

- Regulated platform with tiered user protection

- Simplified automation for passive investors

Cons:

- Limited control over trade logic or execution parameters

- No open API for equities or multi-asset trading

- Unsuitable for custom-built algorithmic bots or high-frequency strategies

6. IG — Best for Retail Forex and CFD Automation

Verdict:

Suitable for traders automating forex and index CFDs with regulated infrastructure and broad asset coverage.

Key Features:

IG provides algorithmic access to over 17,000 instruments, including forex, indices, commodities, and cryptocurrencies. The platform supports REST and streaming APIs with secure authentication and full trading lifecycle control. Orders can be placed, modified, and canceled via programmatic access.

Execution latency is competitive for retail standards, backed by IG’s global server network. Supported order types include market, limit, stop, trailing stop, and guaranteed stops with risk control features.

Tool Compatibility:

API is compatible with Python, Java, and JavaScript libraries through IG’s SDKs and REST documentation. MetaTrader 4 integration is available for automated trading via Expert Advisors (EAs). ProRealTime provides no-code automation with advanced charting tools and backtesting capabilities.

Strategy design can be executed through IG Labs with sample scripts, sandboxes, and developer support forums.

Costs & Commissions:

IG follows a spread-based pricing model. No direct commissions on forex or index CFDs. Overnight funding and guaranteed stop premiums may apply. Data fees are generally waived for active users. No cost for API access with funded accounts.

Pros:

- Wide global asset support with stable API access

- Supports MetaTrader 4 and ProRealTime automation

- Strong regulatory backing and user protection

- Transparent pricing with no platform fee for API users

Cons:

- API suited for intermediate to advanced developers

- No FIX protocol or high-frequency infrastructure

- Limited custom strategy support outside supported tools

7. MetaTrader 5 (via Broker) — Best for Custom Forex Bots and Strategy Scripting

Verdict:

Designed for retail and semi-professional traders building automated forex strategies using native scripting and signal systems.

Key Features:

MetaTrader 5 (MT5) is a multi-asset trading platform offering integrated automation through the MQL5 language. The platform supports algorithmic trading, copy trading, and expert advisor (EA) deployment across forex, indices, commodities, and stocks—depending on broker support.

Latency depends on the underlying broker’s execution architecture. MT5 supports hedging, partial order fills, depth of market, and customizable execution modes.

Tool Compatibility:

Strategies are developed using MQL5, a C++-based language. MT5 includes an in-built strategy tester for single and multi-threaded backtesting with real tick data. The terminal also supports integration with Python via bridge libraries, third-party plugins, and data connectors.

MT5 Marketplace allows access to pre-built indicators, EAs, and signal providers. Compatible with brokers offering MT5 connectivity across global markets.

Costs & Commissions:

Platform usage is free, but trading costs depend on the selected broker. Most MT5 brokers follow a spread-based or hybrid model. VPS services, premium indicators, and copy signals are optionally priced through the MQL5 marketplace.

Pros:

- Full automation through native scripting (MQL5)

- Supports multi-asset trading from one interface

- In-built backtesting and strategy optimization tools

- Broker flexibility for cost and instrument access

Cons:

- Execution speed and reliability vary by broker

- Lacks REST or FIX API for advanced integrations

- Complex strategy logic requires scripting knowledge

8. NinjaTrader — Best for Futures and Custom Indicator Automation

Verdict:

Optimized for algorithmic traders focused on futures and technical indicator-driven systems using a proprietary scripting engine.

Key Features:

NinjaTrader enables algorithmic trading through NinjaScript, a C#-based language for building custom strategies and indicators. It supports live, simulated, and backtest trading across futures, forex, and equities. The platform offers real-time order routing and market depth visualization.

Execution latency is minimized through direct exchange connectivity via CQG and Continuum data feeds. The platform allows bracket orders (Pre-defined entry, target, and stop-loss – automates risk control, used in volatile markets), OCO, trailing stops, and time-based logic.

Tool Compatibility:

Compatible with C# development environments. Strategies can be created using NinjaScript Editor, Strategy Builder (no-code), or imported DLLs. Advanced charting, data analytics, and order flow tools are integrated into the desktop platform.

No native REST or FIX API is available, though third-party solutions provide bridging to external platforms like Python or Excel.

Costs & Commissions:

NinjaTrader uses a tiered pricing structure: Free (basic features), Lease (monthly/yearly), and Lifetime license (one-time). Futures commissions start at low rates via partnered brokers. Data feeds and exchange access incur separate fees. No cost for strategy development in demo mode.

Pros:

- Custom scripting via NinjaScript with deep strategy control

- Direct futures market access with institutional feeds

- Advanced charting, tick replay, and order flow analytics

- Multiple brokerage integration options (e.g., Phillip Capital, Dorman)

Cons:

- No native API for external automation

- Desktop-only architecture limits flexibility

- Premium features locked behind license tiers

9. Tradier — Best for API-Centric U.S. Equities Trading

Verdict:

Built for developers automating U.S. equity and options trades via a fast, developer-first REST API-Stateless API using HTTP, easy to use for web-based algos, suited for general automation.

Key Features:

Tradier offers direct access to U.S. stocks and options through a robust REST API with full trading, account, and market data endpoints. It supports real-time order routing, live market feeds, and event-based webhook integration. Execution is handled through a brokerage-as-a-service infrastructure, allowing flexible routing and custom execution logic.

Ideal for traders building custom front ends or integrating Tradier’s backend into proprietary dashboards or third-party platforms like QuantConnect or MotiveWave.

Tool Compatibility:

Supports native REST API with detailed developer documentation. Works seamlessly with Python, R, and Node.js environments. Integrated with major third-party algo tools including QuantConnect, OptionStack, and Amibroker. Also supports Excel via plugins and Zapier-style automation for no-code workflows.

Costs & Commissions:

Tradier offers a flat-rate monthly pricing model ($10/month for unlimited trades via TradeHawk) or per-trade pricing for lower-volume users. API access is free with a funded account. No data fees for end-of-day feeds; real-time data incurs exchange charges.

Pros:

- Developer-first API with full trading + account control

- Seamless integration with top algo platforms

- Flat-rate pricing option for active traders

- Low-cost options trading with strong routing

Cons:

- U.S.-only asset support

- Not ideal for ultra-low-latency execution

- Limited native analytics or backtesting tools

10. Zerodha (Kite Connect) — Best for Indian Market Algo Deployment

Verdict:

Suited for developers automating NSE and BSE strategies with direct market access and native Python SDKs.

Key Features:

Zerodha’s Kite Connect API enables full-cycle algorithmic trading for equities, derivatives, and commodities on Indian exchanges. RESTful architecture supports order placement, modification, portfolio access, and historical data retrieval. WebSocket streaming enables real-time feed consumption with millisecond-level updates.

Execution is routed through Zerodha’s low-latency infrastructure, optimized for Indian market hours. Strategy types supported include scalping, positional, and event-based triggers.

Tool Compatibility:

Official SDKs available in Python, Node.js, and Java. Compatible with platforms like QuantInsti, Amibroker (via plugins), and custom dashboards. KiteXL provides Excel-based automation for low-code users.

Developers can integrate models with external databases, notebooks, or cloud-based execution pipelines. Extensive sandbox and developer console for testing and logging.

Costs & Commissions:

Kite Connect API access is subscription-based (monthly). Trading charges follow a flat ₹20/order structure across segments. Exchange transaction charges and GST apply separately. No additional platform or data fees for live execution once subscribed.

Pros:

- Direct access to Indian stock and derivatives markets

- Official Python SDK with strong documentation

- Low flat-fee brokerage with no hidden costs

- Reliable real-time feed via WebSocket API

Cons:

- API access requires separate monthly fee

- Limited to Indian exchanges (no global assets)

- WebSockets may require custom reconnection logic

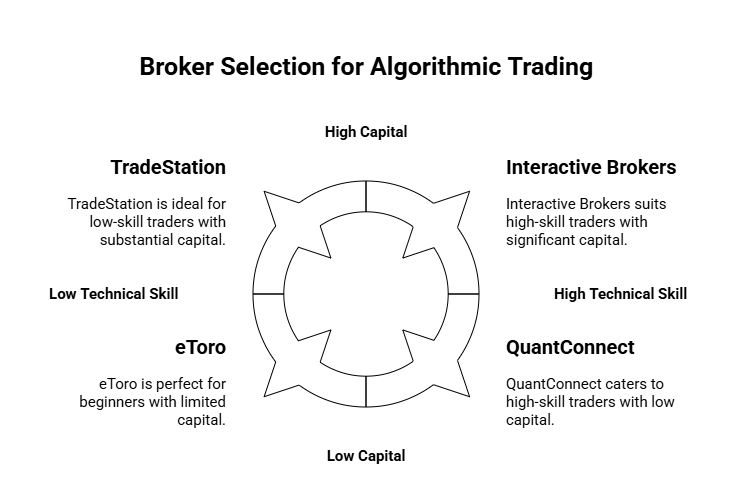

Which Broker Matches Your Trading Style?

Choosing an algorithmic broker requires aligning the platform’s strengths with your execution logic, capital, and coding capability. Use this quick filter to find the best match for your trading style:

For Coders & DIY Builders

Traders coding in Python or C# should prioritize brokers offering full REST APIs, open-source frameworks, and community SDKs. Look for platforms like Interactive Brokers, Alpaca, and QuantConnect. These brokers provide data access, custom strategy deployment, and integration flexibility across cloud or local environments.

For Scalpers & HFT Setups

Speed-sensitive traders need brokers with direct market access (DMA) and ultra-low-latency routing. TradeStation, Lightspeed, and NinjaTrader offer co-located servers, smart order routing, and millisecond-level execution, ideal for rapid-fire strategies and tick-based triggers.

For Beginners or Low Capital Traders

If starting with limited funds or testing strategies, choose brokers with no account minimums, paper trading, and zero-cost execution. eToro, Alpaca, and Zerodha offer simplified onboarding, live demo accounts, and flat-fee structures for testing or learning automation.

For Swing Bots or Passive Execution

Algorithmic swing traders benefit from historical data, backtesting tools (simulating strategy on past data, checks viability before going live to prevents costly real trades) and delayed order models. Brokers like QuantConnect, MetaTrader 5, and IG offer simulation environments, event-driven strategy frameworks, and delayed fill modeling for time-based automation.

Final Recommendation Matrix — Who Should Pick What

Use this final checklist to map your trading profile to the broker that best fits your needs:

| User Type | Best Broker | Why |

| Beginner | Alpaca | Zero minimum deposit, free paper trading, easy API onboarding |

| Quant Developer | Interactive Brokers | Deep global market access, Python SDK, full control via IB Gateway |

| Scalper / HFT | TradeStation | Ultra-low latency, direct market access, precision order routing |

| Passive Bot User | eToro | CopyTrader infrastructure with automated syncing and no-code execution |

FAQs

Q.1 Do I need coding experience?

Not necessarily. Many platforms offer both code-based systems (e.g., Python APIs, MQL5) and no-code tools like strategy builders, copy trading, or visual blocks.

Q.2 Which broker has the best API?

It depends on your use case. REST APIs are easiest for general automation. FIX protocol-Financial Information Exchange, high-speed trading standard, used by institutions for ultra-fast orders suits high-frequency setups. WebSocket APIs deliver live market data streams for real-time decisions.

Q.3 Can I trade 24/7?

Only crypto-focused brokers offer 24/7 trading. Equity, derivatives, and forex brokers follow exchange hours or allow after-market orders during extended sessions.

Q4. Are all of these regulated?

Yes. Every broker listed is regulated in at least one top-tier jurisdiction (e.g., SEC, FCA, SEBI, ASIC), ensuring legal compliance, fund safety, and market transparency.

Q5. Can I backtest strategies?

Yes. Brokers like IBKR, MetaTrader 5, and QuantConnect offer built-in or third-party integrations for strategy testing. Historical data quality and simulation accuracy vary by platform.

Discover overlooked trading insights on our blog.