Hedging is a financial technique used to limit potential losses by taking an offsetting position in a related asset. It does not eliminate risk but reduces exposure to adverse price movements. The strategy aims to maintain portfolio value during market volatility or unfavorable asset performance.

This article explains how hedging works, and how individual investors can apply it using practical tools. It covers real-world examples, common strategies, and step-by-step guidance for portfolio-level or asset-specific protection.

Hedging vs Diversification vs Speculation

Hedging is a risk management tool designed to protect against downside.

vs

Diversification spreads risk across uncorrelated assets to reduce overall volatility but does not offset specific losses.

vs

Speculation, in contrast, seeks to profit from market movements and accepts risk as a core objective. While hedging limits potential losses, speculation aims to maximize potential gains.

What Hedging Can—and Can’t—Protect You From

Hedging can protect against specific, identifiable risks such as equity drawdowns, currency fluctuations, or commodity price swings. It is effective when the correlation between the primary asset and the hedge instrument is negative or inverse.

However, hedging cannot protect against systemic risk, liquidity crises, or unforeseen macroeconomic shocks. It also does not guarantee gains or full capital preservation.

What Hedging Is—and Isn’t

| Hedging Protects Against | Hedging Does Not Protect Against |

| Sector-specific downturns | Broad market crashes (unless broad-based) |

| Currency devaluation in FX exposure | Liquidity shortages |

| Volatility in specific asset classes | Credit events or default risks |

| Interest rate fluctuations | Opportunity cost of missed upside |

Why Do People Hedge? (Use Cases That Matter)

Preserving Gains

Hedging is commonly used to lock in unrealized profits without liquidating the underlying position.

Investors with significant capital appreciation in equities or commodities may use options or inverse instruments to offset potential declines while retaining upside exposure.

This allows gain protection without triggering tax events or altering long-term positions.

Managing Risk in Volatile Markets

Market volatility introduces unpredictable price fluctuations across asset classes. Hedging strategies such as protective puts, volatility index derivatives, or inverse ETFs are employed to reduce drawdown risk during uncertain periods.

The objective is not to eliminate volatility, but to absorb its impact on portfolio value and maintain capital stability.

Protecting Against Sector or Currency Exposure

Hedging is essential when portfolios are concentrated in a specific sector or exposed to foreign currency risk.

A tech-heavy portfolio, for example, can be hedged using sector-specific ETFs or options. Individuals with international income may use currency forwards or ETFs to mitigate FX losses due to exchange rate shifts.

Scenario-Based Use Cases

- Job Loss Hedge: An employee heavily compensated in company stock may hedge through options to avoid overexposure in the event of termination or company underperformance.

- International Income Protection: Freelancers earning in USD but residing in INR-denominated economies may hedge against INR appreciation using currency ETFs or options.

- Concentrated Holdings: Investors with disproportionate holdings in one stock or sector can use collars or sector hedges to protect downside without full divestment.

Realistic Hedging Examples (Non-Institutional)

Hedging a Tech-Heavy Portfolio with Inverse ETFs

A portfolio concentrated in high-growth technology stocks is exposed to sector-specific volatility. Inverse ETFs, such as those tracking the Nasdaq-100, offer a liquid mechanism to hedge downside risk.

These instruments rise in value as the underlying index declines, offsetting losses without liquidating core holdings. The hedge should be size-adjusted to match exposure and time-bound to short-term volatility windows.

Protecting Stock Gains with a Put Option

A put option provides the right, but not the obligation, to sell a stock at a predetermined price. Investors use protective puts to limit downside after significant price appreciation.

For example, a shareholder with gains in a mid-cap equity can buy a put at a strike slightly below the current price, capping losses while retaining upside. The cost of the put (premium) defines the hedge’s effective protection.

Currency Hedging for Freelancers or Expats

Individuals earning in a foreign currency and spending in a local currency face ongoing exchange rate risk.

Freelancers paid in USD but residing in India can hedge INR/USD risk using ETFs, currency options, or forward contracts. This protects purchasing power from INR appreciation, which would reduce real income over time.

| Bonus: Business-Level Hedging (Airlines, Exporters) Corporate hedging typically targets input costs or revenue volatility. Airlines hedge fuel prices using oil futures to stabilize operating margins. Exporters selling in USD but incurring costs in local currency hedge with FX contracts to lock in conversion rates. These strategies aim to preserve profit margins despite commodity or currency price fluctuations. |

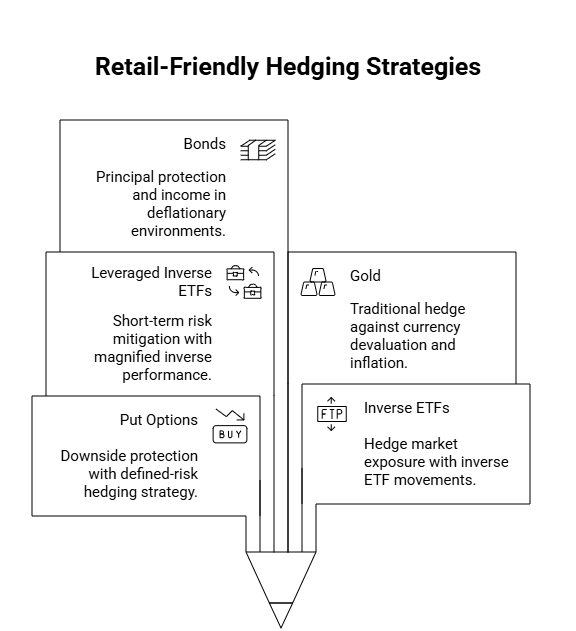

Tools You Can Use to Hedge (Retail-Friendly)

Put Options and Protective Puts

Put options offer downside protection by granting the right to sell an asset at a specific price within a set time frame. Protective puts are applied to individual stocks or indices to cap potential losses.

This method is cost-efficient for defined-risk hedging and allows continued participation in upside movements.

Inverse and Leveraged ETFs

Inverse ETFs are designed to move in the opposite direction of a given index, providing a straightforward way to hedge market exposure.

Leveraged inverse ETFs magnify inverse performance, suitable for short-term risk mitigation.

These instruments are accessible through standard brokerage platforms and do not require derivatives accounts.

Gold, Bonds, and Defensive Assets

Gold serves as a traditional hedge against currency devaluation, inflation, and systemic uncertainty. Government bonds provide principal protection and income in deflationary environments.

Defensive equities—such as utilities or consumer staples—can act as indirect hedges due to their resilience during economic contractions.

| Bonus: Futures for Advanced Retail TradersFutures contracts allow precise exposure control to commodities, indices, or interest rates. Retail traders with margin-enabled accounts may use index futures to hedge broad portfolio risks or commodity futures to stabilize input costs. Futures require active monitoring and carry significant leverage, making them suitable only for experienced participants. |

| Bonus: Crypto Hedging (If You Trade Altcoins)Crypto traders may hedge altcoin exposure using stablecoins, inverse tokens, or options available on platforms such as Deribit or Binance. This is relevant when managing volatility in DeFi tokens or during prolonged market corrections. Execution must account for liquidity, slippage, and counterparty risk in decentralized environments. |

Common Hedging Strategies That Actually Work

Portfolio-Level Hedging

Portfolio-level hedging focuses on offsetting systemic risk across an entire investment portfolio. Instruments such as index options or inverse index ETFs are used to counteract broad market downturns.

This approach is capital-efficient and scalable but may offer limited precision in protecting individual assets.

Asset-Specific Hedging

This strategy targets downside protection for a single stock, sector, or currency exposure. Tools include protective puts, covered calls, or asset-paired hedges. It enables high accuracy and custom risk control. However, it can be costlier and require continuous management.

Correlation-Based Hedging

Correlation-based hedging involves pairing an asset with another that typically moves in the opposite direction.

Examples include hedging equities with volatility products or currencies with commodities. Effectiveness depends on the stability of historical correlation. Unexpected correlation breakdowns can reduce hedge reliability.

Comparison of Hedging Strategies

| Strategy | Use Case | Pros | Cons |

| Portfolio-Level Hedging | Broad index or macro risk | Scalable, efficient, suitable for ETFs | May under- or overhedge specific exposures |

| Asset-Specific Hedging | Single stock, sector, or currency exposure | High precision, customizable | Higher cost, ongoing rebalancing |

| Correlation-Based Hedging | Multi-asset portfolios with known patterns | Diversified hedge approach, creative flexibility | Correlation shifts may invalidate hedge effectiveness |

How to Hedge Step-by-Step (For Individuals)

Step 1 – Identify the Asset/Risk to Hedge

Start by isolating the exposure that requires protection. This could be a specific stock, sector concentration, foreign currency flow, or the entire portfolio. The hedge must correspond directly to the risk being addressed to avoid misalignment in coverage.

Step 2 – Choose the Right Tool

Select a hedging instrument based on liquidity, time horizon, and precision. Use options for targeted protection, inverse ETFs for broader coverage, or defensive assets for long-term hedging. The choice should balance effectiveness, cost, and accessibility.

Step 3 – Set Time Frame and Amount

Define the hedge duration and capital allocation. Short-term volatility hedges may last days to weeks, while structural exposure may require rolling strategies. Calculate position sizing relative to asset value or portfolio weight to avoid under- or over-hedging.

Step 4 – Execute and Monitor the Hedge

Implement the hedge through your trading platform or brokerage. Monitor performance regularly to ensure it moves inversely to the protected asset. Adjust or unwind the hedge as market conditions or exposure levels change.

Checklist: Individual Hedging Execution

- Identified the exact exposure (stock, portfolio, currency)

- Selected a tool aligned with exposure type and risk tolerance

- Defined duration of risk and hedge coverage period

- Calculated position size to match exposure proportion

- Placed hedge through a secure, liquid instrument

- Scheduled reviews to monitor and adjust the hedge

Cost, Risks & Mistakes to Avoid

Hidden Costs (Premiums, Fees, Opportunity Loss)

Hedging carries explicit and implicit costs. Option premiums, ETF expense ratios, and transaction fees reduce net returns.

Additionally, opportunity loss occurs when a hedge limits upside participation in favorable markets. The cost-benefit balance must be evaluated before implementation.

Overhedging or Hedging Too Often

Excessive hedging can dilute overall portfolio performance and create complex, overlapping exposures. Overhedging may lead to unintended losses if the market moves favorably. Frequent re-hedging increases transaction costs and introduces timing risk.

Misunderstanding How the Hedge Reacts to Market Moves

Hedges must be aligned with the asset’s behavior and market environment. A mismatch in correlation, duration, or instrument type can cause the hedge to underperform or amplify risk.

Traders often assume perfect inverse behavior, which may not hold during extreme volatility or low liquidity.

Final Thoughts – Should You Try Hedging?

- Hedging is a strategic way to manage financial risk by reducing exposure, not eliminating it.

- Individuals can hedge with accessible tools like put options, inverse ETFs, or defensive assets.

- Successful hedging requires understanding your risk, selecting the right instruments, and sizing the position correctly.

- It’s not about forecasting markets — it’s about controlling outcomes when markets move against you.

Next Steps:

Before applying any hedge with real capital, consider backtesting strategies, paper trading through your brokerage, or consulting a qualified financial advisor.

FAQs

Q1. Is hedging only for professionals?

No. Many hedging tools—such as inverse ETFs and gold—are accessible to retail investors. While advanced strategies like options require more knowledge, basic hedging can be done through standard brokerage accounts with proper risk understanding.

Q2. Can I hedge with just ETFs?

Yes. Inverse and sector-specific ETFs allow portfolio hedging without using options or futures. While less precise than derivatives, they are efficient for short-term protection and easy to implement through common trading platforms.

Q3. Is hedging the same as insurance?

Not exactly. Hedging reduces potential losses through financial instruments but doesn’t guarantee compensation like insurance. It mitigates risk exposure without eliminating it, and its effectiveness depends on strategy design and execution.

Q4. Do I need a brokerage with options enabled?

Only if using options-based strategies. For protective puts or spreads, an options-enabled brokerage account is required. Other tools—like ETFs, defensive assets, or gold—do not need special permissions and can be accessed via basic accounts.

For trusted analysis and tips, visit our trading blog.